Vanness provides financial and strategic consulting services to the railroad industry both domestically and internationally. Additionally, we provide services in connection with the FRA RRIF loan program to the federal government and to prospective borrowers.

Now that earnings season is well along and many of you will already have a good idea of 2017 results, it is a good time to again take up the subject of the FRA’s RRIF program. What makes the RRIF lending program worth a closer look are two factors even the big boys (KCS, Amtrak, etc.) are finding attractive.

The interest rate you will be charged will be at a level equivalent to the rates paid by the US Treasury on the same maturity bonds, a recent RRIF loan interest rate was set at 2.7%, at the bottom of the interest cycle. Rates are now about 3.4% for long treasuries and a good assumption for this year’s average would be 3.5-4%. The second attractive feature is FRA’s ability to set the maturity of its loans up to 35 years for long-lived track and infrastructure assets, thereby matching the principal and interest payments to the financial cash flow from the assets, better than any commercial financing.

On the other hand, this is not a grant program. The FRA must look at the railroad’s ability to repay the loans with interest, and it must perform all the customary credit calculations. The FRA in turn calculates a “credit risk premium” which, if the loan is approved, will be charged as a single payment insurance premium to compensate for the risk to the Treasury of accepting loans having less than the Treasury’s credit risk. Unfortunately, many small railroads concluded the credit risk premium was a show stopper because it must be so big for small railroad borrowers. This is a misperception: the premium is spread among all loans made by Treasury and the cost is generally very modest compared to the financial benefits.

The FRA offers to consult with eligible borrowers about requirements as a first step of its process. The most frequent question we hear is: “How do I know I can come close to qualifying financially?”

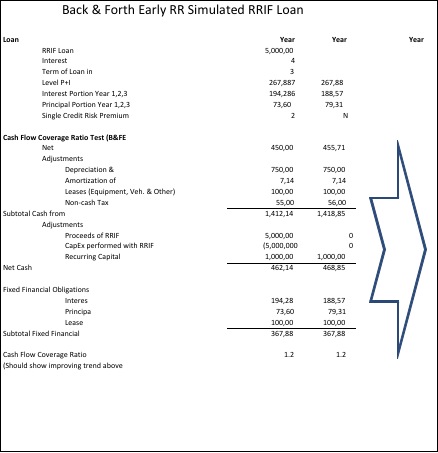

You can test your own credit score with the mathematics of the following sample “cash flow coverage ratio” calculation which is one of the principal formulas used by credit analysts to assess a borrower’s credit capacity based on historic and projected P&L data.

Let’s say the Back & Forth Early RR needs to make a $5,000,000 investment in long lived tracks for a major makeover, to handle present traffic more efficiently and safely. It could go to the bank, but the maximum bank loan maturity would not come close to matching the economic life and cash throw off of the assets. Neither a working capital revolver nor the usual seven years maturity could be paid off with the operating cash flows in seven years.

In step one, using a conventional mortgage calculator, we calculated the RRIF annual (for simplicity) level payment and the principal and interest components for the $5,000,000 assumed loan. The BF&E brings down $450,000 to earnings, below the line non-cash items like amortization, depreciation and deferred taxes are added back, along with all financial expenses for interest and leases to come to cash flow from operations alone.

The next step is to account for any financing inflows such as the RRIF loan proceeds. Then, capital expenditures are deducted from the cash stream to arrive at Net Cash Flow.

Net Cash Flow is divided by Fixed Financial Obligations consisting of all outstanding Interest, Principal and Lease payments, in other words the “debt service” that the cash flow needs to cover, to show a Coverage Ratio.

Financial analysis has two perspectives: looking back (historical due diligence) and looking ahead (earnings projections). Historical results are valuable for analysis of large and generally stable companies. The ability to look ahead is important especially where the RRIF investment is expected to improve profit and cash flow.

What is desired is a Coverage Ratio of 1 times coverage or more, and showing a tendency to rise over time to display the positive effects RRIF induced cost improvements and, possibly, growing traffic.

The BF&E is a highly simplified example. In the real world there may be multiple draws of RRIF funds, uneven results during major investment periods due to service disruptions, and the need during a multi-year project to tailor loan terms to some degree. FRA has the authority to do all of this to fit borrower and project requirements.