Click here to open the PDF

Benefit Cost Analysis

Transportation infrastructure projects typically display significant public benefits by virtue of improved transportation options for users, substitution of greener transportation forms, or preservation of a threatened transportation service. The null versus invest cases can be evaluated by an Economic Impact Analysis (EIA) and within that broader context; a subset is a focused Benefit Cost Analysis (BCA).

Establishing a favorable Benefit to Cost relationship is an extremely important policy consideration for public sector finance activities and, increasingly, in private sector project marketing as well. Vanness has performed EIA and BCA analysis for these types of projects in association with Strategic Planning Group for:

- Urban passenger transportation solutions

- Logistics parks and comparative assessment of modes of transport

- Substitution of one mode of transport for another

- Commercial and urban development and/or redevelopment

Broad Gauge Impact Analysis

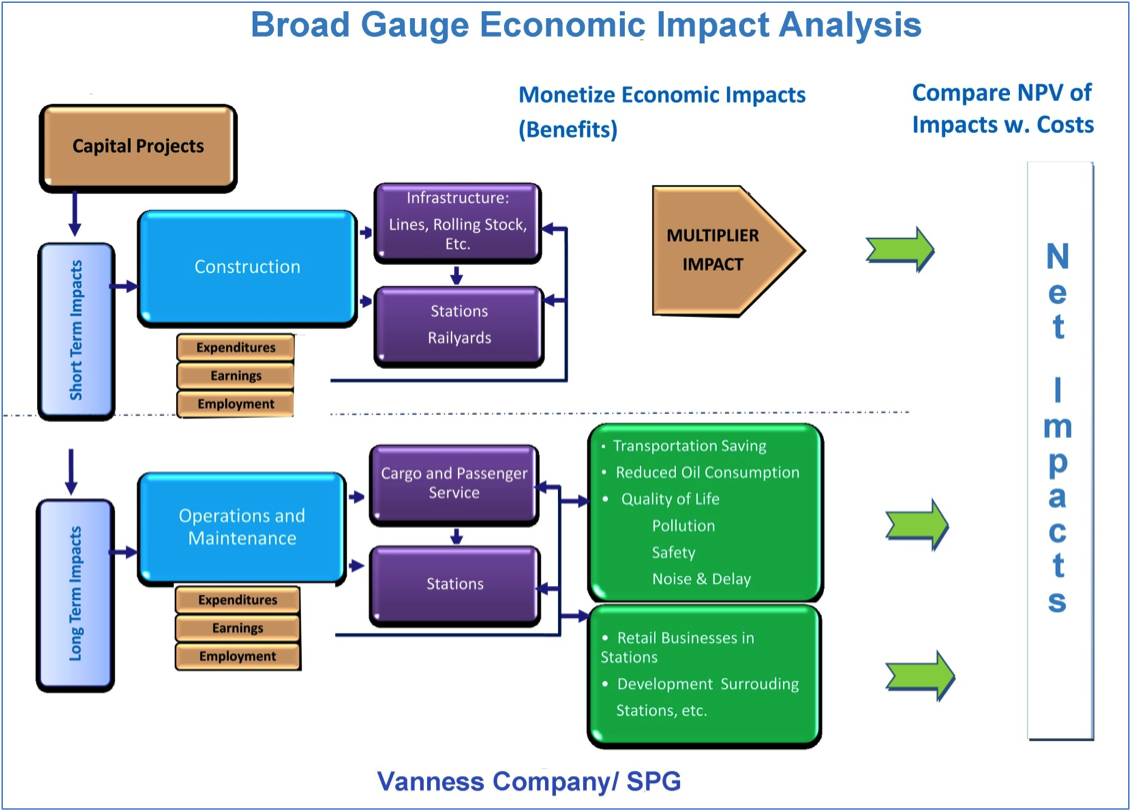

The economic process involves two steps. First, the relevant elements of public and private benefit are identified from the nature of the project and the activities proposed then, they are “monetized”. The diagram below shows the many facets of a broad-based economic impact analysis for a hypothetical rail project.

Impacts are typically divided into short and long time frames and typically the first or Construction Phase accounts for the bulk of the investment in Capital Projects Costs assigned to the project. Capital renewal costs may be incurred in the longer term as well but are typically not considered part of the immediate analysis or are expressed as asset renewal reserves on an ongoing basis in BCA analysis.

- Short Term Impacts: This includes the impacts of the Construction Phase investment in terms of expenditures, employment and earnings.

- Long Term Impacts: The same analysis can be made for the ongoing Operations and Maintenance Phase where expenditures, employment and earnings are also measured for the expected life of the project.

- Typically, Multiplier Effects on downstream activity such as derived employment, benefit to local businesses, tax revenue increments, etc. are taken into account in economic impact analysis.

Make “Cargo and Passenger Service” Freight and Passenger Services

Monetizing Benefits

Some benefits can readily be counted in terms of money equivalents e.g. investments and ongoing expenditures, employment earnings, and business profits by measuring the invest versus the null case. Similarly, estimates of transportation savings, fuel savings and downstream benefits to business around stations, and real estate development and tax revenue accretion can be readily converted to money terms. Social or Quality of Life benefits must be measured then converted to money equivalents.

Quality of Life Impacts

These can include emissions pollution and quality of life variables such as noise, safety and delay of traffic considerations. These are quantified first in units and then benefit/savings coefficients are established for each of them using best available sources and experience in relating them to the project. Credibly monetizing these intangible benefits is an integral part of any EIA/BCA and is a matter of intuition and experience.

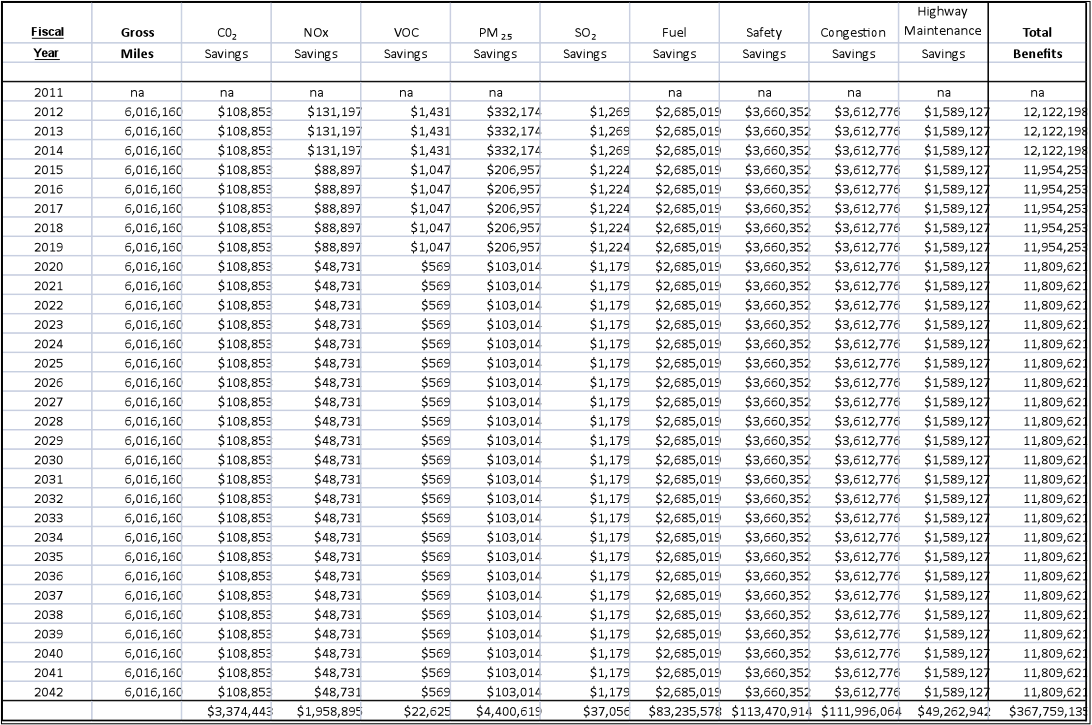

As illustrated below the various benefits can be arrayed in a matrix by years and relevant variables and savings for each year are calculated by multiplying activity units times monetized values. Discounted present value can be conveniently calculated using appropriate discount factors depending on private or public financing and using the matrix row contents by year[1].

[1] The above table illustrates a hypothetical example of gross (undiscounted) benefits calculations for a project involving substitution of rail for highway mode in a highly congested urban impact area. For illustration, gross mileage has been shown although benefits might be predicated on other variables like number of vehicle trips, vehicles crossing rail tracks, vehicle weights, etc.

Tailoring the BCA to fit Institutional Requirements

For transportation projects seeking federal funding, the OMB has authored Circular A-94, defining methodology, approved discount rates, addressing project risk and distributional effects. As a corollary, The USDOT has created a set of guidelines for presenting TIGER grant applications to them. These include guidance on which elements are admissible[1], how to present the calculations and how to portray overall results.

[1] Generally, transfer payments such as interest, taxes, and profits are not admissible and secondary, multiplier impacts are not admitted. Depending on program, retail and development benefits may or may not be admitted.